UK inflation: Four things the latest figures tell us

Getty Images

Getty ImagesYour money is being stretched as the pace of price rises has risen.

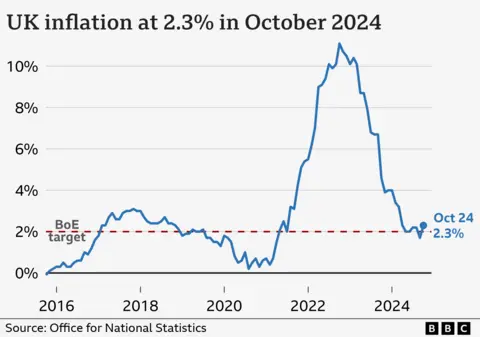

The inflation rate, which charts the rising cost of living, increased to 2.3% in October.

Prices aren’t soaring at the rate seen over recent times. Inflation peaked at 11.1% two years ago. But, there is concern about the impact the situation is having, and will have, on people’s finances.

Here are four ways these figures affect you.

1. The cost of living crisis isn’t over

Any trip to the supermarket reminds us that prices have risen sharply in recent years.

Compared with October 2020, prices of goods and services are 24% higher – driven by increases in food and energy prices.

That shows the ongoing impact of price rises over the last few years, irrespective of what’s happening now.

While high inflation is considered harmful, a small amount of inflation is considered necessary to drive economic growth.

The target rate for the Consumer Prices Index (CPI) measure of inflation, set by the government, is 2%.

At 2.3%, the rate is close to that level, but is at its highest level for six months.

Wages are rising at a faster rate, offsetting some of these prices increases, but charities’ worries are growing about those on benefits.

Most working-age benefits, such as Universal Credit, will go up by 1.7% in April – which analysts predict will be below the pace at which prices are rising.

Lots of people are still struggling to pay back debts that built up over the last few years. Some £3.7bn is collectively owed to energy suppliers from people unable to pay their gas and electricity bills, for example.

2. Inflation is volatile

Analysts had expected a smaller rise in inflation than 2.3%.

But you shouldn’t put too much store on a one-month figure.

As with any economic statistic, one month’s data can buck a general trend and should be considered alongside other published data.

It is worth noting too that some of the factors driving the latest rise in prices came from outside of the UK.

Higher energy costs are primarily the result of price of energy on the global markets, but which have an impact on households’ and businesses’ bills.

3. Interest rate cuts will be more gradual

Interest rates affect the cost of borrowing and the returns available for savers.

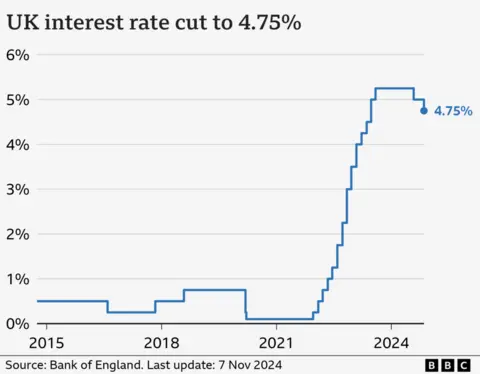

The benchmark – or base – rate, set by the Bank of England currently stands at 4.75%. It was cut from 5% earlier this month.

This is the chief tool used by the Bank to try to keep inflation at its 2% target. Raising rates cools borrowing and spending, thus limiting price rises, and vice versa.

With inflation much lower than its peak, the Bank has – and still is – expected to reduce interest rates.

But recent events, such as the Budget and now a higher-than-expected inflation rate, mean the markets have revised their predictions for when and how often those cuts will come.

Even the Bank’s governor cautioned they could not be cut “too quickly or by too much”, prompting forecasts that the base rate is unlikely to be reduced in December.

The impact for homeowners is that fixed mortgage rates have actually been creeping up, despite the latest interest rate cut.

Official figures show the cost of renting a home has also risen. Average rent paid to private landlords was up 8.7% in year to October, the ONS says.

Savers, however, may see the interest paid on their savings hold up better than would otherwise be the case.

4. We don’t know what will happen next

Global and domestic factors will have a significant impact on how quickly prices rise, but how they will play out remains uncertain.

Donald Trump’s victory in the US presidential election was helped by his decision to tap into voters’ concerns about the cost of living, analysts have suggested.

He has pledged a blanket 20% tariff on all imports into the US.

If he goes ahead and introduces tariffs – a tax imposed by one country on the goods and services imported from another – it could lead to a rise in prices, including in the UK, economists say.

Domestically, measures in the Budget, such as a rise in National Insurance paid by employers, has led to fears that the extra cost could be passed on in higher prices or fewer jobs.

However, other events could have a positive impact. A swift, relatively orderly, end to conflicts such as the war in Ukraine could settle the global economic outlook – albeit the impact of such geopolitical complexity is extremely difficult to call.

How can I save money on my food shop?

- Look at your cupboards so you know what you have already

- Head to the reduced section first to see if it has anything you need

- Buy things close to their best before date which will be cheaper and use your freezer

Read more tips here