UK economy returned to growth in August

Getty Images

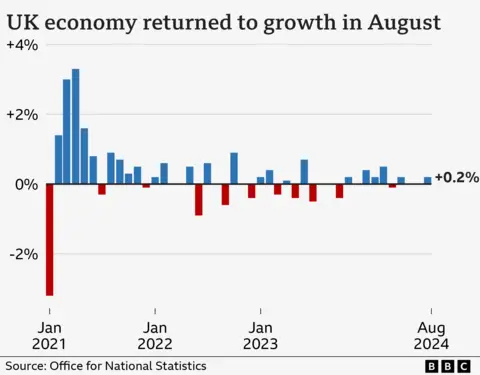

Getty ImagesThe UK returned to growth in August but the “broader picture” is one of a “slowing” economy in recent months, the official statistics body has said.

A bounce back in construction and strong month for accountancy, manufacturers and retail businesses helped boost the economy by 0.2%, after it failed to grow in the previous two months.

But economic growth is weaker compared with the first half of the year, the Office for National Statistics (ONS) said.

Its latest figures come as the government prepares for the Budget at the end of October.

Prime Minister Sir Keir Starmer has warned the Budget will be “painful”, with the government admitting some taxes will rise.

Liz McKeown, director of economic statistics at the ONS, said accounting, bookkeeping and auditing businesses had helped to boost the economy alongside retail and manufacturers in August.

She added construction also bounced back from July’s downturn, with new infrastructure projects starting up, but added: “The broader picture is one of slowing growth in recent months, compared to the first half of the year.”

Ben Jones, lead economist at the CBI business group, said it was clear some firms had “paused hiring and investment decisions” before getting “more clarity over the direction of the new government’s economic policies” in the Budget.

“The big question mark is the government’s vision for the economy,” said Barret Kupelian, chief economist at PwC, adding that for economic growth to be sustained, “businesses, households and foreign investors require certainty to make choices”.

There is growing speculation over what tax rises the Chancellor, Rachel Reeves, will announce, given the government has promised not to increase the burden on “working people” and ruled out increasing VAT, national insurance or income tax.

A hike in capital gains tax has been rumoured. This is charged on profits made from the sale of an asset that has increased in value, such as second homes. Other choices available to the chancellor include reducing the tax relief on pensions and raising fuel duty.

The Budget will be the government’s first big opportunity to set out its spending and taxation priorities, but it comes against a backdrop of higher debt following the pandemic, higher interest rates and inflation that has only recently returned to normal levels.

Reeves is planning to change borrowing rules to free up billions of pounds more in spending for big projects in a bid to boost the economy, but the move will not prevent her introducing further tax rises.

The chancellor said on Friday that growing the UK economy was the government’s top priority, “so we can fix the NHS, rebuild Britain, and make working people better off”.

The ONS monitors GDP – or gross domestic product – on a monthly basis, but more attention is paid to the trend over three months. Weaker performance earlier in the summer meant growth of just 0.2% between June and August compared with the previous three months.

At the end of last year the UK fell into a shallow recession, with the economy contracting for two three-month periods in a row. Growth rebounded in the first half of 2024.

‘Shift the narrative’

The latest growth figures come ahead of an International Investment Summit in London next week, where the government will try to attract billions of pounds of investment into the UK.

Anna Leach, chief economist at the Institute of Directors, said the government needed to “shift the narrative” away from the country’s debt pile and instead focus on “building tomorrow’s economy”.

“That’s the key to sustainable public finances and higher living standards,” she said, adding both the investment summit and Budget provide opportunities for the government to attract investment by explaining its plans in more detail.

On Friday, the owner of Scottish Power – Spanish energy giant Iberdrola – announced plans to double its investment in the UK over the next four years from £12bn to £24bn.

Keith Anderson, chief executive of Scottish Power, told the BBC’s Today programme that the cash would be used to expand the UK’s electricity grid in order to connect more homes and businesses.

He said the main thing the company had asked for the government to do was to speed up the planning process in order to complete projects faster.

“If you make planning twice as fast, we will invest twice as much money, and that is what we are bringing forward today,” he said.

The government plans to almost entirely replace fossil fuels with clean and renewable energy from UK electricity production by 2030, though critics claim it is not achievable in the timeframe and will send bills higher.

People, mostly in rural areas, also have concerns over the construction of the pylons, cables and substations needed to transmit electricity around the country.

But Mr Anderson said the spike in energy bills in recent years was caused by gas prices being “volatile” and that switching to wind power would lead to bills falling “over a number of years”.